Once again, US retail sales for video game hardware, software, and accessories presented a mixed picture. October 2014’s overall retail sales ($790.7 million) were just about the same as October 2013 ($791.3 million), with a massive 59 percent rise in hardware sales (to $273.5 million) and 22 percent rise in accessories sales (to $166.8 million) offsetting the 27 percent decline in software sales (which dropped to $350.3 million from last year’s $482.6 million).

On the one hand, it’s clear that the PS4 and the Xbox One have done very well in their first year. Last month marked the one year anniversary of both the PS4 and the Xbox One in the US retail market, and NPD declared that these new consoles are selling far better than the last generation did at launch. “October 2014 marks the first 12 months of sales for the Xbox One and PS4; and after the first year, these consoles have had a great start as cumulative sales are currently over 70 percent higher than the combined first year totals of Xbox 360 and PS3,” said NPD’s Liam Callahan.

Left out of the congratulations is Nintendo’s lagging Wii U console, which has now been passed up in total sales by both the Xbox One and the PS4. Despite the boost provided by Mario Kart 8, and the expected boost from Super Smash Bros., it’s clear that the Wii U is still on course to be the worst-selling console in Nintendo’s history. The recent price reduction of the Xbox One to $349, and the bundled software offered by many retailers for the holidays, puts it around the same price as the Wii U — with a far greater library of software and a massive power advantage. That’s a heavy burden for Nintendo to overcome, with key new Wii U titles slowly making their way to market.

Overall, though, hardware is a bright spot for retails stores, providing much-needed dollars to keep the numbers looking good. “Hardware sales of eighth generation consoles represent close to 80 percent of dollar sales this month driving overall consoles sales to increase by 186 percent over October 2013,” said Callahan.

Microsoft noted that the $50 price cut for the Xbox One has driven the total units shipped over 10 million worldwide and tripled its weekly sales, outselling the PS4 by nearly two-to-one over the past few weeks. That 10 million unit number puts the Xbox One not too far away from Sony’s PS4 at 13.5 million worldwide. Sony applauded its PS4 sales in an infographic, noting that the PS4 has 56 million unique active users that have spent over 1 billion hours playing online.

Accessories were also a cheery note for retail stores, as the category rose 22 percent for the month. “Accessory sales in October 2014 grew by 22 percent over October 2013, due to increased sales of gamepads, headsets/headphones, and video game point and subscription cards,” Callahan said. “Gamepad sales were related to hardware growth as the top items were for the Xbox One and PS4.” The category was also helped by strong sales of digital value cards. “This month marked the best October on record for video game point and subscription cards, beating out the second best October, which happened to be last October, by 24 percent — another sign that consumers are starting to shift their purchasing towards digital,” Callahan added.

The picture for retail video game software is a very different one, and NPD struggled to present the picture in a positive light. “Declines in software this month were driven by further declines of seventh generation software, which were not fully offset by gains in eighth generation consoles,” Callahan noted. “New launch performance was also soft as games that launched this month sold 42 percent fewer units than the games that launched in October 2013. Despite, however, the declines in sales this month of seventh generation software, research from our quarterly Games Market Dynamics: U.S. showed that usage of seventh generation consoles across Q3’14 is still larger than that of eighth generation consoles.”

This shift is beginning to worry analysts. “Given the strong shift toward new-gen games that is apparent from recent data, and the fact that digital currently appears to be taking as much as 25 percent share of total new-gen sales depending on the game, we continue to expect total Q4 physical unit sales to be down double-digits year-over-year,” wrote analyst Doug Creutz of investment firm Cowen and Company.

GameStop seems to be working hard to overcome this retail weakness through a variety of efforts, by Creutz is concerned about other retailers like Walmart and Target that have significant video game sales. Those retailers just aren’t putting in the same effort for the category that GameStop is. Certainly the next two months will have massive sales, and the Black Friday deals are already generating tremendous interest. The new year will likely dawn with a continuing sales problem for retail software, as more dollars head to digital.

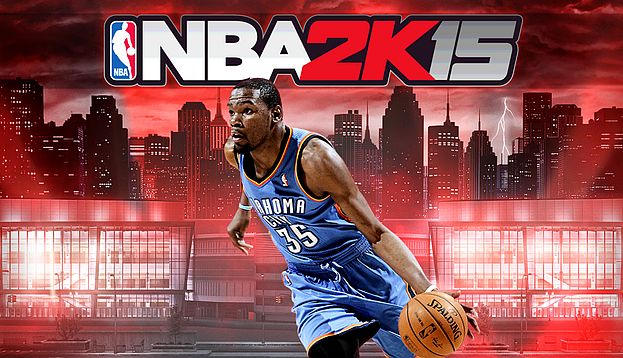

October 2014 Top 10 Games (New Physical Retail only; across all platforms incl. PC)

1. NBA 2K15 (PS4, XBO, 360, PS3, PC) Take 2 Interactive

2. Super Smash Bros. (3DS) Nintendo

3. The Evil Within (PS4, XBO, PS3, 360, PC) Bethesda Softworks

4. Borderlands: The Pre-Sequel! (360, PS3, PC) Take 2 Interactive

5. Destiny (360, XBO, PS4, PS3)** Activision Blizzard

6. Skylanders Trap Team (360, Wii, NWU, PS3, XBO, PS4, 3DS, MOB)** Activision Blizzard

7. FIFA 15 (PS4, 360, PS3, XBO, Wii, PSV, 3DS)** Electronic Arts

8. Madden NFL 15 (360, PS4, PS3, XBO)** Electronic Arts

9. Middle Earth: Shadow Of Mordor (PS4, XBO, PC) Warner Bros. Interactive

10. Minecraft (360, PS3, PS4) Microsoft / Sony

**(includes CE, GOTY editions, bundles, etc. but not those bundled with hardware)