Stock prices for Facebook reached record heights on Thursday, after the company announced significant growth in company revenue and drastically increasing Facebook ad CPMs and declining user activity.

Speaking on a call with investment analysts, Mark Zuckerberg boasted that in Q4, Facebook ad prices rose by 43 percent over the same period in 2016. By comparison, the number of impressions served by these more expensive ads increased by only 4 percent.

This price-impression disparity can be explained by Facebook’s recent algorithm updates, which devalued and publisher content in an effort to drive “quality” over “quantity” interactions.

“When you care about something, you’re willing to see ads to experience it,” Zuckerberg said in the call. “But if you just come across a viral video, then you’re more likely to skip over it if you see an ad.”

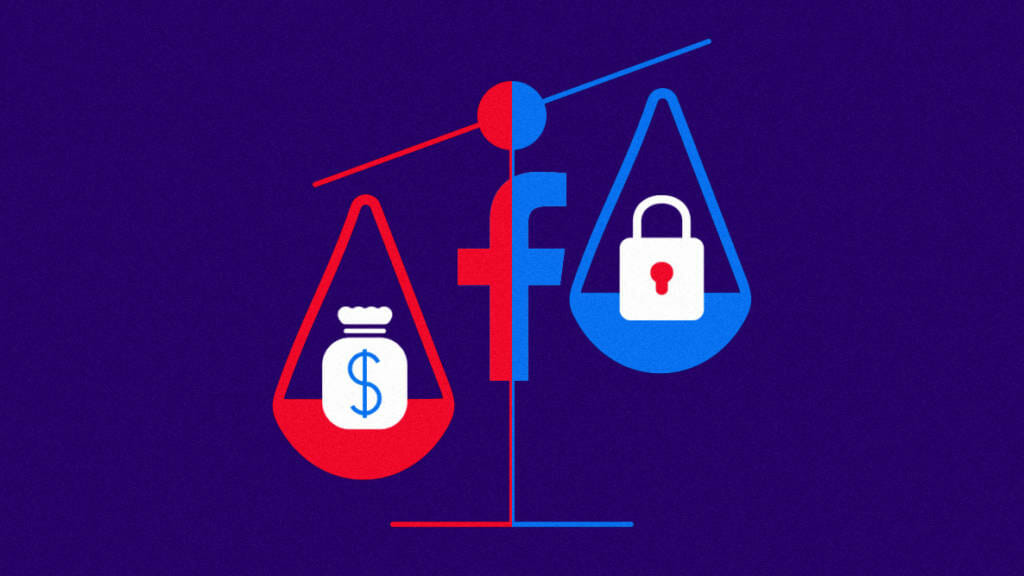

As Facebook tries to reduce toxicity and promote authentic engagement, its audience is spending less time on the platform than before. According to the company’s estimates, its users spent 5 percent less time on its platforms, resulting in 50 million fewer hours on Facebook per day. Additionally, the number of daily active users in the United States and Canada dropped for the first time in the company’s history.

“I want to be clear, the most important driver of our business has never been time spent by itself,” Zuckerberg added. “It’s the quality of the conversations and connection. And that’s why I believe this focus on meaningful social interactions is the right one.”

Facebook’s premium video service, Watch, is growing in popularity in the US, allowing the company to pivot toward higher-CPM video ads over News Feed posts.

After the call ended, Facebook’s stock prices jumped 3 percent to $194.18 per share, the highest in the company’s history.