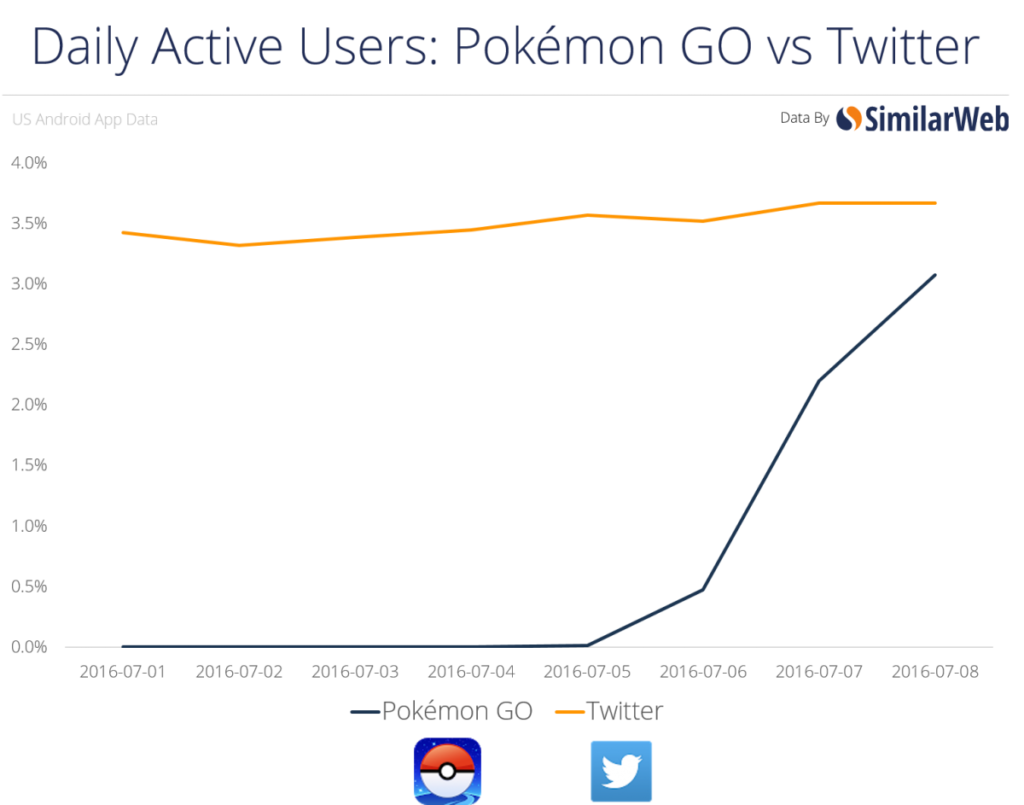

Since its release on mobile last week, Pokémon GO, the new free-to-play augmented reality game featuring the best-selling creature-capturing franchise, has taken over the market. So far, over 7.5 million people have downloaded the game across both iOS and Android, and the AR-enabled game is ready to surpass Twitter in daily active users on Android, reaching 3 percent and coming incredibly close to Twitter’s steady 3.5 percent.

As a result, Nintendo’s stock value has risen immensely, jumping to 718 billion yen ($7.1 billion) since the release of the mobile app.

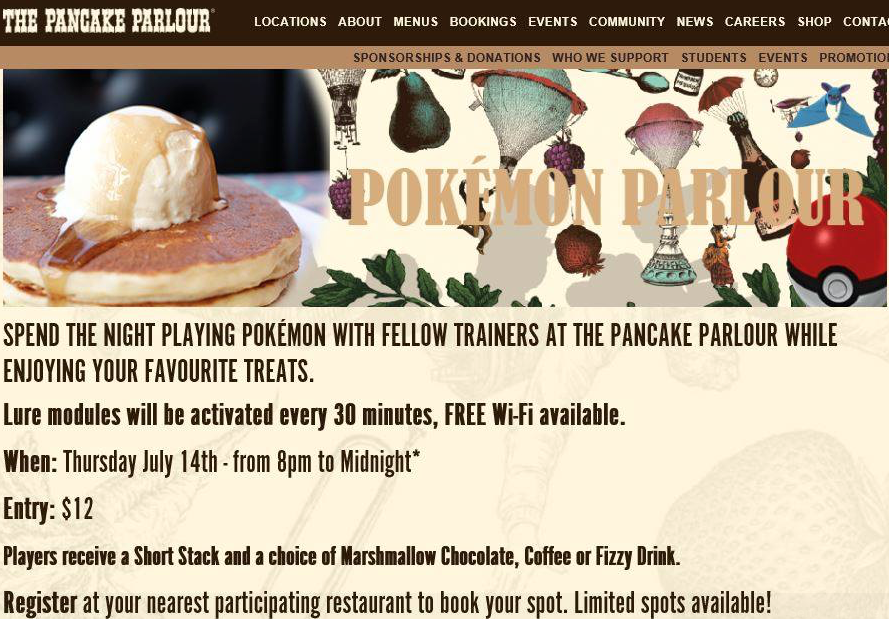

Local businesses have also thrived thanks to Pokémon GO, advertising special discounts and meet-ups for groups looking to find more Pokémon characters. Local businesses showcase playing the game while enjoying food with others.

We’re a Pokéstop in the new Pokémon GO app! Tomorrow we’ll provide non-stop lures during our Monday Mash-In hours… https://t.co/eAAFaCGM3i

— Brewer's Pizza (@BrewersPizza) July 11, 2016

As the game continues to overtake social media and prepares to launch in other regions, including Europe and Japan, [a]listdaily spoke with SuperData CEO Joost van Dreunen about the game’s success, along with how Nintendo and Niantic might continue its momentum.

First, he explained why Pokémon GO’s tremendous success shouldn’t really be a surprise, considering how much the franchise has thrived over the past few years. “Pokémon GO doing so well initially should not be a surprise: it is one of the most enduring and widely popular game franchises in the world,” he explained. “It has produced no fewer than 18 full feature films, a cartoon series, trading card games, and a slew of swag.

“With an existing fan base like this, the game has managed to quickly become a favorite among mobile gamers, and looks like it’s gone viral. Among livestreaming channels, Pokémon GO is now among the top 35 titles, with almost 200,000 hours of content streamed since launch, placing it well above other Nintendo franchises like The Legend of Zelda: Majora’s Mask and Mario Kart 7. More broadly, the mobile games market, which is starting to show declining revenue growth and is currently in a seasonal lull, is going to rely increasingly on franchises and brands to reach audiences.”

The game’s biggest appealing factor, van Dreunen pointed out, is its ease of use with augmented reality. “The mechanic of looking for and catching Pokémon is traditionally integral to the game, and the use of AR takes that to the next level,” he said. “It shows the power of the device that many of us have in our pockets already, and in many ways is one of the first great adaptations of augmented reality technology. Earlier efforts to integrate AR into mobile gameplay, like with Ingress, initially met a large appetite from users, but quickly dropped in rankings and revenue. What set Pokémon GO apart is the strength of the license.”

While initial microtransaction sales of the game have been very good, van Dreunen noted that the development team at Niantic needs to find new content to keep players from waning. “Initial gross revenue is not necessarily an indicator of sustained financial success. If you recall a game like Fallout Shelter, which had a huge launch week in terms of reach and revenue, it quickly dropped to bottom of the top 50. For Pokémon GO to break the bank, it will have to continue to offer its audience new content, like tournaments, and keep people excited.

“Pokémon has a long history of organizing activities around its game, so I have no doubt there will be more coming. Mobile gamer audiences have gotten to expect a prolonged effort from publishers, with regular special events and other incentives to log back on. This is an area where Pokémon can do really well for itself.”

These events and activities are sure to be vital when it comes to Pokémon GO’s future success. “The game has clearly tapped into something and has managed to bypass the usual suspects when it comes to earnings on mobile. But remember that games like Mobile Strike, Candy Crush Saga and Clash of Clans have literally been making millions of dollars a day for years. Certainly Pokémon GO has a the pedigree in terms of license and offers novel game play, but its quest for dominance of the mobile games market has only just begun.”

Van Dreunen then added even more details, discussing Pokemon GO‘s success. “Early estimates indicate that Pokémon GO has so far managed to generate $14.04 million across mobile platforms since its release, putting it ahead of other titles using the franchise, including Pokémon Shuffle Mobile which has earned an estimated $14.03 million since its release in August, 2015.” That makes GO the highest ranked Pokémon mobile release to date.

He also made note of the impact of the game on the VR/AR market. “As the games industry continues to ramp up its efforts behind both AR and VR, the consumer market ultimately requires a ‘killer app’ that will allow mainstream audiences to familiarize themselves with new technology and its applications,” said van Dreunen. “When the iPhone was first introduced, it was games like Angry Birds that taught consumer audiences how to swipe and use a touch screen, which was a novelty at the time. Augmented has been available for some years, and with the popularity of the new Pokémon game seems to have found a suitable application with the ability to both motivate and educate audiences on its uses. Mobile devices are the first point of contact for mainstream consumer audiences with augmented reality, but in the long term companies like Microsoft have devices like the Hololens in development. For 2020E we forecast the total AR market (hardware and software) to reach $4.3 billion in worldwide revenues.”