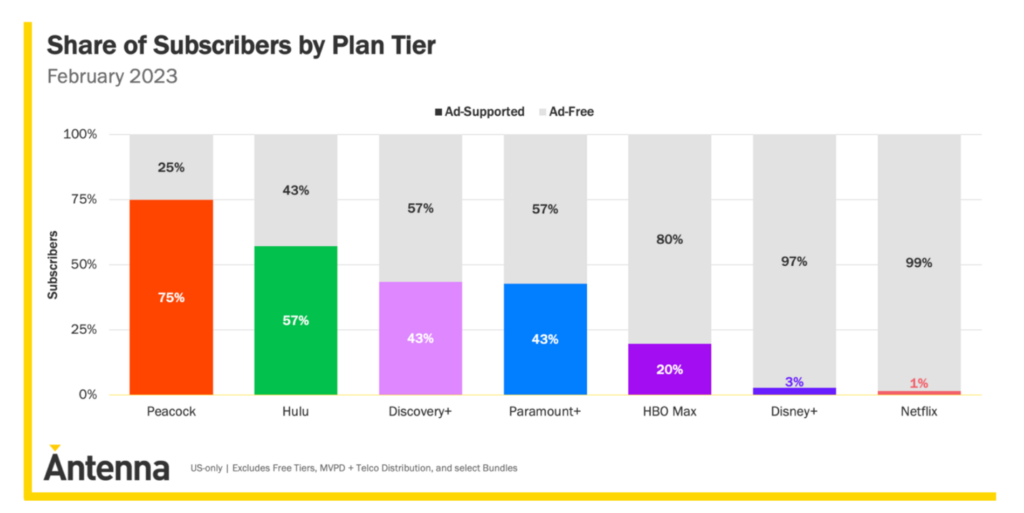

Since its debut in 2018, Max’s drama series “Succession” has been one of the most-covered television series in the last few years, with over a thousand articles covering the finale alone.

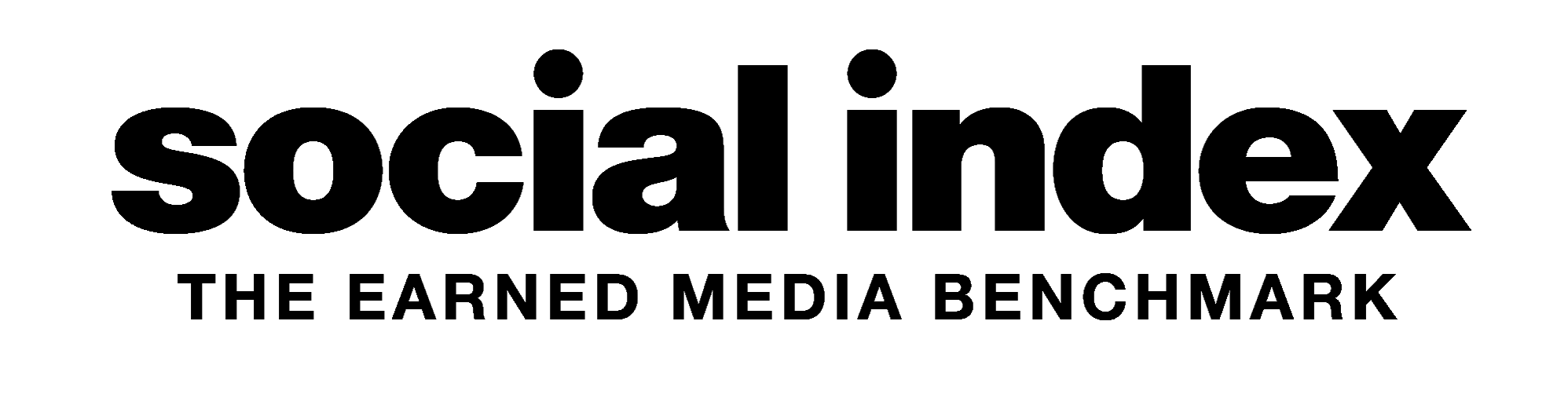

While Max still has fewer ad-supported tier subscribers than other networks, it has a powerful pitch as a destination for prestige advertisers seeking the attention of affluent customers. That’s because earned media value (EMV) can serve as a barometer for advertisers, showing them the best place to invest their budgets to reach targeted audiences.

Source: MediaPlay News

Decoding Succession’s Earned Media Surge

Succession’s buzz continues to surge, even when many of those articles, as Axios points out, fall well below the readership of posts about less trendy shows, like “Young Sheldon.” But the show’s earned media power is not only based on its cool factor: the show’s appeal to publishers may play a role in a surge in advertising dollars that have funneled into Max’s new ad-supported subscriber tier. That rise signals Max’s new efforts to appeal to advertisers may be working—and earned media is likely playing a powerful role in that success.

Advertisers covet Max’s core demographic, which since 2020 has earned the loyalty of adults aged 22-44 as well as more affluent households. In its first quarter report for the year, Warner Bros. announced WBD was the “most-watched Total TV linear portfolio among 25-54.”

Source: Axios

(Advertisers’) Money Wins: How Earned Media Drives Value

Source: YouTube

HBO saw a 29 percent surge in advertising revenue in the first quarter, along with 1.6 million new subscribers, driven by its ad-supported tier, per Warner Bros. Discovery. The brand also decreased its operating expenses by 24 percent and its cost of revenue by 8 percent over the previous quarter—meaning the company is doing everything possible to optimize spending while cutting costs.

Yet with “Succession”’s finale, Max brought in just two sponsors, Mercedes-Benz and Vital Farms; the latter of which presented a 15-second pre-roll video highlighting the brand’s ESG commitments in a spot called “Keeping It Bullsh*t Free.” That limited inventory model may mean that Max focuses on the appeal of high-impact, long-play ads tied to content that packs a similar powerful punch.

“What we thought was really interesting is that we have this [ad] spot that talks about corporate bullshit, and here is a show that is about corporate bullshit, and what an interesting juxtaposition we could create,” Vital Farms CMO Kathryn McKeon told Modern Retail. “And what a bold way of bringing an unexpected brand into a new advertising platform. So, not only was it interesting to be one of the first to try from a pure media standpoint, but the storylines and the interest of that tension made it so much richer of a place for us to bring our message.”

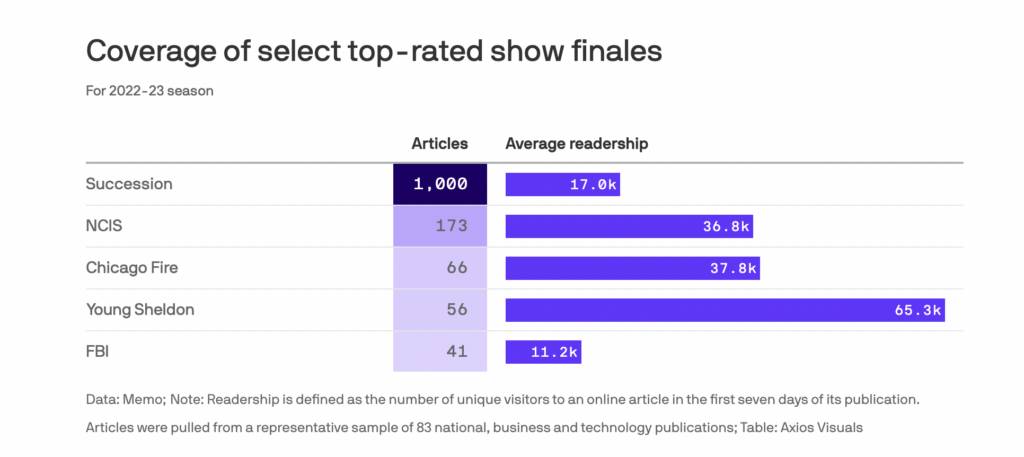

That appeal to advertisers is nowhere more evident than in Succession’s ability to garner social media engagement that is equivalent to a significant ad spend, even after the show is over.

For example, using Social Index, a tool that allows marketers to calculate dollar equivalencies for social media value, we see that a single finale highlight post generated over $66,000 in earned media value through audience engagement.

(Subscribers) Are Not Serious People

The ability to calculate earned media has another significant role in driving revenue— keeping a channel or a popular show top of mind. As consumers discuss and interact with content around specific programming, the ability to calculate EMV allows marketers advertising on streaming services to identify new opportunities to stoke engagement and support new shows that might reach similar audiences. That’s a powerful strategy for advertisers seeking to connect with targeted audiences when popular shows like Succession end. Calculated EMV allows marketers to determine which streaming service offers content targeted audiences care about.

For example, using Social Index, we calculated that a recent YouTube post generated over $150k in EMV, representing the same amount in equivalent advertising value.

The ability to calculate EMV is also critical for marketers seeking clarity over the range of choices when selecting a streaming channel to support—for example—when marketers attempt to gauge the value of staying with Max as it transitioned from HBO to an expanded roster.

EMV: Money Still Wins

Succession’s patriarch Logan Roy’s nihilistic catchphrase “money wins” often applies to how CMOs invest their streaming advertising budgets with networks that have popular shows that offer consistent earned media opportunities. As consumers view and share content around Succession and journalists cover the show, advertisers may gain new exposure as sponsors or direct advertisers.

That’s a win-win for networks like HBO that need to not only hold on to existing subscribers and draw new ones but also prove to marketers that they can provide new opportunities to reach audiences beyond the viewers of top shows like Succession and The Last of Us.

As HBO became Max and added Discovery+ to its roster, it also gained lots of reality and family-oriented programming, which gives marketers new opportunities to reach audiences beyond fans of the former HBO’s prestige dramas. As Logan Roy famously said of his feckless children, subscribers are fickle and constantly searching for the next shiny object. That’s one reason HBO is promoting its war on “churn”—the phenomenon of consumers subscribing to watch a specific show and leaving when it’s over. Churn can hurt advertisers because consumers are attached to the show, not the network. Without the right mix of engaging content, networks lose subscribers or simply get a ton of trial subscribers who never pay and stay long enough to generate trackable engagement for brands.

“The real challenge is the churn,” Warner Bros. Discovery CEO David Zaslav said as he and CFO Gunnar Wiedenfels outlined plans to take Max to the promised land of profitability by next year. “With churn, it’s very difficult to build a strong business.”

Discovery+, launched in January 2021, has had a low churn rate. HBO Max, which launched in May 2020: not so much.

“Driving (down) that churn may be more important than driving the growth. If we can drive down the churn, the growth will be very substantial,” Zaslav said in a statement reported by Variety. “The more people that use it in the family, the more, the more engaged people are, the broader the offering, the lower the churn.”

The Takeaway For Marketers:

Max will offer many new opportunities for marketers to reach its niche, affluent and wider audiences through its combination of general interest shows and prestige programming. But finding where to direct your spending can be challenging since HBO/Max and Discovery+ content can be found on multiple platforms. One simple way to evaluate a potential spending choice is to look at the earned media surrounding specific programming, like “Succession” and its ilk.

Look for passionate fans but also coverage across publications that reach specific audiences—publishers are reading the analytics too, and coverage of shows that connect with findings from their first-party audience data tend to reflect what their readers want. So WSJ and Vanity Fair homages to “Succession” make a lot of sense if you read the data, even if the show’s actual viewership was much less than “House of the Dragon.” Once you know what your audience is saying on social media and the messaging that they engage with around specific programs, you’ll have meaningful insights for your creative and where your campaign should land. Learn more about earned media valuation and how Social Index makes it possible.