(Editor’s note: [a]listdaily is the publishing arm of the Ayzenberg Group.)

As the reliance on content and influencer marketing increases, so has the need for more reliable metrics to report earned media value. Until now, the industry was lacking a formal process to evaluate these values. Both influencer and social marketing are relatively new industries, so analytics to track them are not well-defined. Some social networks don’t even provide basic metrics to report success.

Having worked with several large brands on content and influencer-based campaigns across many verticals, we have been provided the perfect testing ground for EMV metrics. One campaign involved a client in the travel sector. This involved aligning the brand with a top-tier influencer to bring to life travel tips and experiences through a travel vlog video series. The campaign generated five videos and 66 total content pieces across YouTube, Instagram and Twitter. Based on EMV, these drove $143k in earned media value.

How did we arrive at that number? We wanted to put a stake in the ground and help facilitate a process for establishing a standard industry metric, so we decided to create the Ayzenberg Earned Media Value Index (or AEMVI). The AEMVI offers comprehensive benchmarks to evaluate campaign ROI, which we encourage all marketers to leverage. We also invite the community to contribute their feedback to help further establish the benchmarks.

Vincent Juarez, principal of ION and media, and I recently did a webinar about the AEMVI and got some intel at [a]list summit about interest levels on this topic. It quickly became obvious that while everyone has heard of EMV, few have a thorough grasp of the concept and how it can be used.

What Exactly Is EMV?

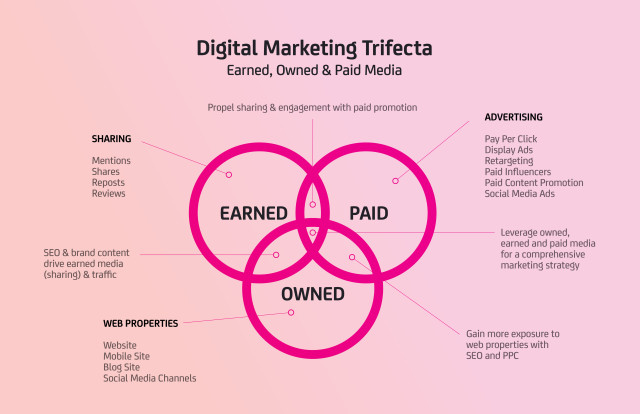

As a brief refresher, most media campaigns fall into three categories: paid, owned and earned media. Paid media includes placements that you can buy based on certain metrics like CPM (cost per thousand impressions) and CPE (cost per engagement). This includes posts on social networks, mobile popups and offline media like TV spots. Owned media has no placement cost since this is content placed on your own channels. Owned media has value based on the cost of buying an ad on your network or channel.

Earned media is the extended value of paid or organic social or influencer activity. Organic social is not owned media because one cannot buy a banner or ad placement on your social channel. There is no paid media behind organic social, therefore it is 100 percent earned media.

The amount of earned media your social content is valued at is dependent on how well the content performed. When you pay for placement, you are paying for a number of specific actions. Anything beyond what you paid for is classified as earned media value and this is dependent on the success of your content. For example, if you paid based on CPV, but also received a significant number of click-throughs, those clicks are classified as earned media. Earned media can be considered as such: If you stopped all organic social activity, how much paid media is needed to achieve the same earned media results?

Why Do We Need EMV?

Impressions are no longer king. We are living in an age of ad-blockers and social reach is declining for brand pages. Marketers are increasingly aware of the declining value of impressions and they are learning why engagement is the real metric to follow. EMVs validate the increasing use of high-engagement influencer and content marketing tactics.

Working at an agency, we understand the need to show the value of influencer and social campaigns. As such, we’re committed to updating our Earned Media Value Index regularly to maintain updated market values and fill this void in the industry. Our approach to determining earned media values is to be unbiased and as thorough as possible by using a comparison-based approach rather than relying solely on our own agency data.

We researched comparable reports and information on valuation/costs, grouping it into four main categories: auction based pricing, paid social and media campaign data, organic social data and third-party publications. Our report focuses on five key verticals: automotive, beauty/fashion, consumer electronics, entertainment and gaming. We evaluated all of our comps, threw out any major outliers, factored in whether campaigns were engagement-focused or funnel-focused and applied weights to the comps accordingly.

For more details on our methodology and rate cards that can be used to evaluate the ROI of your campaigns, a report is available for download here and the index is available in real-time on ayzenberg.com. The report is also syndicated and available through eMarketer.

To contribute rate cards to our study or to provide feedback, please email aemvi@ayzenberg.com.