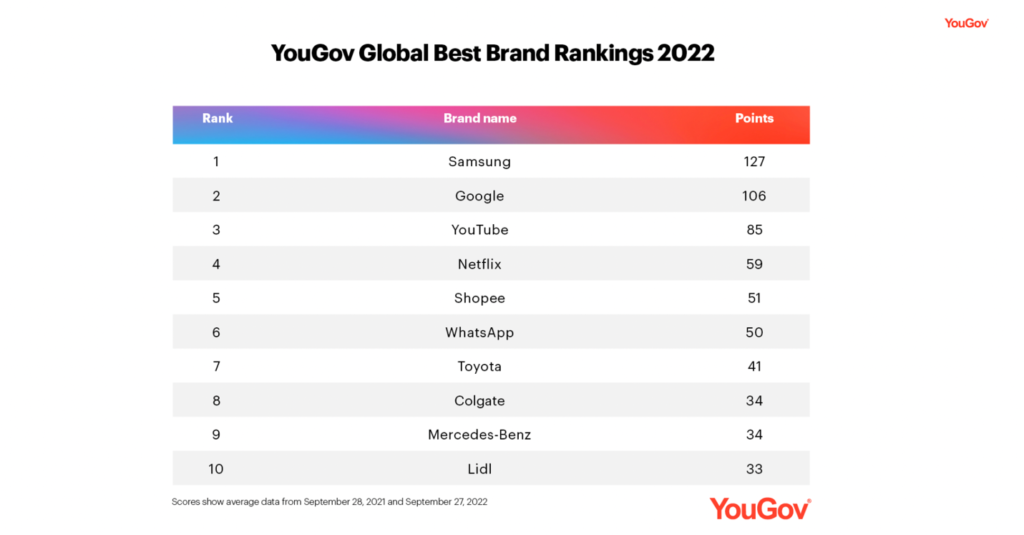

Amazon and Nike are two of the biggest absences on YouGov’s annual Best Brands list, derived from a survey of thousands of consumers.

Samsung focuses on user experience and rises in rank; Amazon and Nike exit list

Samsung, which also ranks in the top 5 on Interbrand’s Best Global Brands List, is now number one on YouGov’s latest brand value report. According to the company, the brand invested in making its products more amenable to connected experiences through partnerships with Google and Microsoft, providing consumers with new gaming experiences, and ensuring stable supplies for next-generation applications to avoid supply chain delays that impact customer experience.

The brands on YouGov’s annual Best Brands list are ranked based on YouGov BrandIndex’s Index score, which the company states is “a measure of overall brand health calculated by taking the average of Impression, Quality, Value, Satisfaction, Recommend and Reputation.” The Index Rankings chart shows the brands with the highest average Index scores between September 28, 2021, and September 27, 2022.

Last year, the top five were dominated by digital brands: Google, Samsung, Netflix, YouTube, and WhatsApp comprised the top five. That reflected different times—tech, streaming, and social media brands had not yet begun the intermittent periods of volatility and dramatic slide in stock market values when the 2021 survey was completed in September of that year. Those stock market values have an explicit connection to how consumers interact and assess their user experience with digital brands, as well as how readily they are signing up for (or abandoning) subscriptions.

YouGov’s top 10 brands in 2021:

Brands fighting challenges on all fronts, while customers look for deals and the right overall experience

By late October 2022, a Q3 drop in big tech share values reflected warnings from tech giants, including Amazon about consumers’ hesitant spending. But YouGov’s metrics measure consumer satisfaction—not just general sentiments around a brand. Recently, Amazon’s customer satisfaction hit an all-time low, with the company’s consumer experience ratings lagging behind Nordstrom and Costco in one major survey by The American Customer Service Index. In YouGov’s latest Best Brand survey, Amazon is absent.

Another standout absence is Nike. While the company posted an increase in sales in Q3, earlier global supply chain issues have impacted Nike, which boasts 95 percent brand awareness and 90 percent brand loyalty, per Statista. Slow shipping times impact consumers’ user experiences, and even when it isn’t a brand’s purview, customers can associate those failures with the brand’s value. Per a March press statement, Nike revealed that it has overcome previous supply chain issues related to the closure of half of its factories in Vietnam and was able to produce at pre-closure capacity. While amping up production to meet customer demand may have helped alleviate one end of the supply-chain issue, transit times for retail goods have still been erratic in the US in 2022—and this can impact consumer satisfaction and consumers’ patience with retailers.

For example, a recent survey revealed that 65 percent of shoppers polled stated they will abandon shopping with a retailer altogether after two or three late deliveries. Another 81 percent stated that if a retailer sends an incorrect order two or three times, they will also abandon shopping with that retailer altogether.

Brand loyalty aside, in times of economic uncertainty, consumers tend to reevaluate their purchasing habits and focus on affordability, value, and user experience. All three elements are important to shoppers as their lifestyle needs change and they are faced with a range of shopping alternatives, such as resellers offering the same or lookalike brands with faster shipping. This may make it harder for legacy brands to maintain customer loyalty when external issues—like shipping delays—tamper with user experience.

Download the entire report here.