Direct-to-consumer companies are continuously disrupting industries leaving long-standing brands scratching their heads about how to regain lost market share—about 10 percent—from fast-growing upstarts.

A picture of this has never been more clear than comparing direct-to-consumer mattress companies with legacy veterans’ activity on social media.

It’s not even that the products themselves are necessarily disruptive—these companies are simply being advantageous of leveraging digital channels and refreshing branding to appeal to status-oriented millennials.

As more and more DTC mattress companies are opening up traditional showrooms, it’s clear that the success of the direct-to-consumer model isn’t really just about cutting out the “middleman,” but about developing communities around these products and creating a bit of a halo of aspiration online.

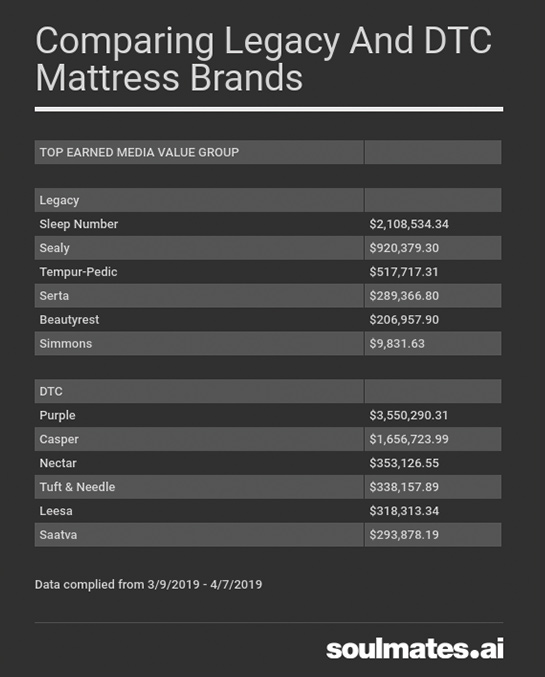

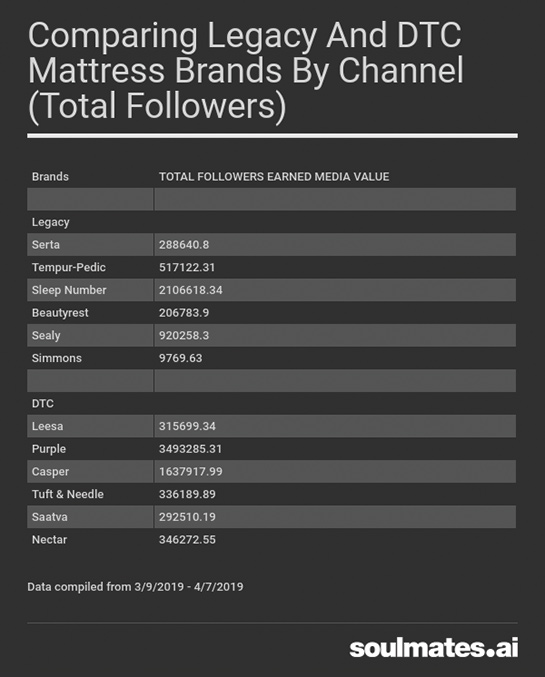

With data from Soulmate’s ROI Reporter, we are able to compare what was happening across channels and how much earned media value was being generated by leading mattress brands.

The data shows a stark contrast and sheds light on how companies like Casper, Leesa and Purple have quickly become recognized brands.

Let’s take a look at a few companies on both sides of the mattress industry to dig into what is happening here with data pulled from March 9 to April 7, 2019.

Direct-To-Consumer

Casper

Casper is likely the first example that comes to mind when thinking of DTC mattress companies, and it is not surprising—according to a report from Retail Dive in 2018, the mattress brand commands 50 percent of the total market share of the direct-to-consumer mattress space.

Primarily, Casper has focused on leveraging Facebook and Instagram to generate this massive growth, both of which continue to be its key platforms of focus today.

According to Soulmates.ai, Casper is the second-leading DTC mattress company in terms of follower earned media value and skews the highest with Facebook average earned media value ($1,070) and Instagram average earned media value ($156) of all mattress companies.

Purple

Of all the brands included in this report, Purple ranks the highest for earned media value. The direct-to-consumer mattress company has made these big gains by focusing on a channel most others have paid little-to-no attention to: YouTube.

For Purple, the average earned media value on YouTube posts is $2,090; the brand also produces quite a bit of review-based influencer content on the platform.

Beyond creating engaging content, Purple also succeeded in getting the highest earned media value for followers on any platform, worth an astonishing $2,300,517.18 in EMV for just a 30-day period.

Legacy

Sleep Number

Aside from a rather dreary picture from the rest of the pack of legacy brands, Sleep Number stands out as one making significant strides on social media. As the second-best performing company overall from brands in this report, Sleep Number is also seeing this success translate to their bottom line.

Sleep Number performed consistently in 2018 with

The company has also taken a diversified approach to platforms with high levels of growth across Facebook, Instagram, Twitter and YouTube channels, partially driven by a partnership Sleep Number has with the NFL.

While the best performing platform for Sleep Number is Facebook ($1,792,599 in Facebook follower earned media value), the company is also far-and-away the top legacy brand on YouTube ($186,117 YouTube follower earned media value).

Serta Simmons

Now to provide some contrast: Simmons, a mattress company founded in 1870, does not appear to have capitalized on its legacy brand equity in the social space. One reason could be the company’s diversification of product brand names, like Beautyrest. The company has neither an Instagram nor a YouTube account and has just over 5,000 likes on Facebook, with the last post dated as May 2012.

Sister brand Serta, whose iconic counting sheep ads gained the company prominence in the early aughts continues to be a mainstay for the brand but has not translated to success in the social space with infrequent posts.

Tuft & Needle, another disruptive direct-to-consumer brand, agreed to a merger with Serta Simmons Bedding in late 2018, so it remains to be seen how the legacy brand will leverage newfangled DTC insights.